Amazon Seller Payment Schedule: Everything You Need to Know

As an Amazon seller, you know getting a constant cash flow in your bank account is extremely important for the growth of your business. However, the Amazon Seller Central Payment Schedule is often frustrating and unpredictable.

Most sellers say they get paid by Amazon every 14 days. But if Amazon decides to hold the money for some reason, it puts you in a tough spot.

And even if Amazon releases the payment, there’s no guarantee that you’ll get paid 100% of the amount.

So, have you ever wondered why Amazon has such as wide buffer time to send your hard-earned money to your bank account?

In this article, we’ve compiled a complete guide on Amazon seller payment schedule, how it works to help sellers understand Amazon’s payment terms, what actions they can take to get payments faster, and more.

With a better understanding of the Amazon Seller Payment Schedule, you can adjust your cash flow and control your business better.

Let’s jump into it.

Here is a quick peek into the article:

- What Are the Standard Amazon Seller Payment Terms?

- How Does Amazon Seller Payment Schedule Work?

- What are Amazon Daily Payouts and Next-Day Payouts?

- How Can I View My Payment Schedule on Amazon?

- What Is An Amazon Account Level Reserve?

- Why Did I Get a Reserve On My Account?

- Amazon’s Reserve Tiers

- How to Avoid An Account-Level Reserve

- How Can I Get Amazon Seller Payouts Faster?

- Why Haven’t I Been Paid Yet?

- How to Stay Ahead of the Amazon Seller Payment Schedule

What Are the Standard Amazon Seller Payment Terms?

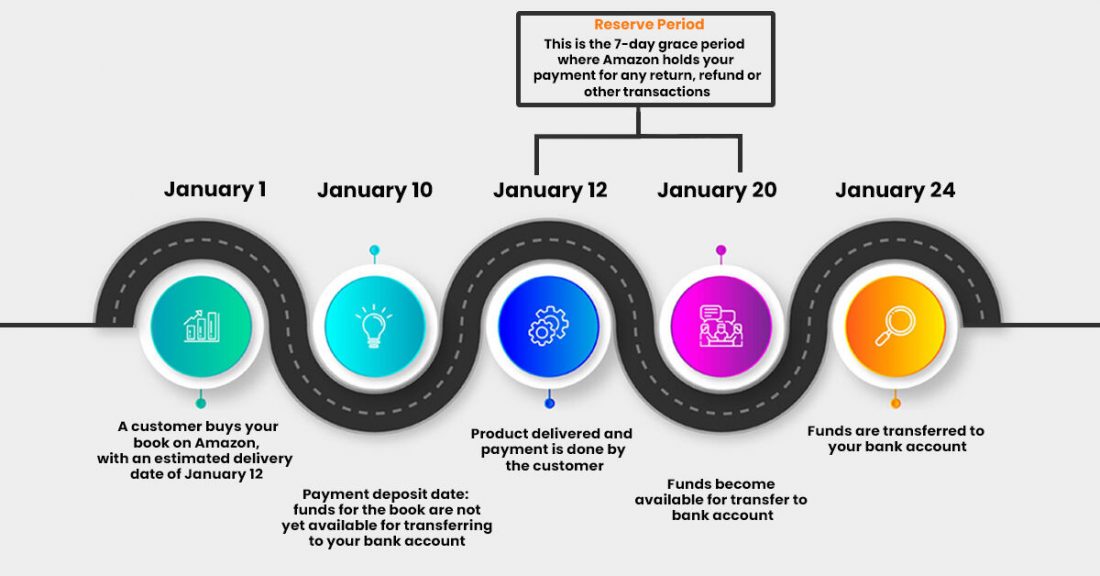

According to Amazon’s Payment Terms, Professional Sellers are paid every two weeks for orders delivered at least 7 days from the latest estimated delivery date. Amazon takes the 7-day buffer time to give the buyers time to inspect the ordered products and issue refunds, if any.

However, it means sellers experience delays in receiving full payment compared to brick-and-mortar stores.

In certain situations, sellers may experience a delay in receiving payment, extending beyond the standard 14-day payout period. This delay can occur due to factors like the timing of order delivery close to the payout date or the transfer processing time. For instance, if orders are delivered within seven days of the scheduled payout date, the remaining balance will be carried over to the next payment cycle.

Since Amazon uses ACH transfers as the payment method, sometimes the fund can take 3-5 business days to be visible in the seller’s bank account.

Note: Amazon might hold back all or part of your payment for more than 14 days as an “account level reserve.”

Now, these terms are for Amazon Sellers, but what about Amazon vendors?

Amazon provides three payment terms for Amazon Vendors: Net 30, Net 60, and Net 90. These terms indicate that vendors receive payment after 30, 60, or 90 days, respectively.

All three methods are long-term, meaning vendors may encounter cash-flow issues due to the delayed payment schedule.

How Does Amazon Seller Payment Schedule Work?

Amazon utilizes ACH (Automated Clearing House) transfers as the only payment method for sellers. And since these are not the Same Day ACH transfers, you can expect to see the funds in your bank account within 5-6 business days after the initiation of the fund transfer.

This 5-6 day is on top of Amazon’s 14-day pay cycle. So, in reality, it could take around 20-21 days before the payment hits your bank account.

When the payment is deposited into your bank account, it may have different labels depending on the type of transaction.

- Amazon Payments, Inc.: This label indicates transactions where the buyers pay before receiving the shipment. For example, receiving $2000 through net banking/card payments will be labeled as Amazon Payments, Inc.

- Amazon Services LLC: This label indicates transactions where the buyer pays after they receive the shipment. For instance, receiving $500 through Cash on Delivery will be labeled as Amazon Services LLC.

Do Amazon Sellers Get Paid Right Away?

Amazon doesn’t pay any sellers right away. However, if you are a reputed seller on Amazon with 10 years of selling history, then you might qualify for the next-day payouts. More on that later!

What are Amazon Daily Payouts and Next-Day Payouts?

Although Amazon doesn’t transfer money before 14 days by default, there are ways to get paid early through Daily Payouts and Next-day Payouts.

Let’s learn about these:

Daily Payouts

Don’t be deceived by the name. Amazon doesn’t automatically send payouts daily to sellers. However, you can use the “Request Transfer” button on your Seller Central payment dashboard to request payouts early.

But this is still not a real-time payout. The “Request Transfer” button only initiates the transfer of the currently available amount in your seller central account (i.e., It’s the sales amount for orders sold 14 days ago that are available on your account).

Next-Day Payouts

To be eligible for next-day payouts, the seller must meet certain criteria.

- You have a seasoned seller account: If you have been selling on Amazon for over 10 years, you might become eligible for Next-day Payouts.

- 3rd Party Instant Access Solutions: If you are a relatively new seller, you can tie up with Instant Access Solution providers like Razorpay to get Next Day Payouts.

Every morning when Amazon’s sales day ends, these solutions purchase the receivables owed to you by Amazon and make 80% of that fund available to you the following day. For example, if you made $1000 in sales on Monday, you will receive $800 by Wednesday. The solution will retain the remaining $200 to cover returns, replacements, or other charges. This remaining amount will be paid to you according to the normal payout schedule.

These next-day payout services help you improve your cash flow, turn inventory quickly, and accelerate business growth.

Recommended read: Is it possible for a seller to have multiple Amazon accounts?

How Can I View My Payment Schedule on Amazon?

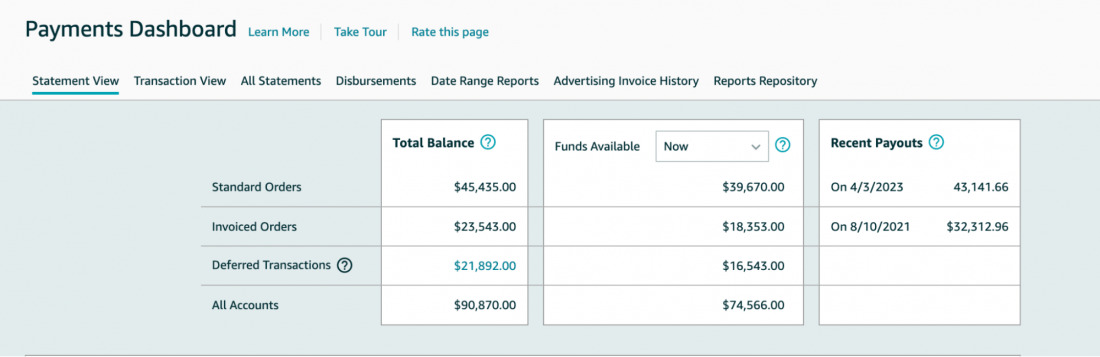

The Payment Dashboard in the Seller Central account shows you exactly how much you’ll be paid and by when. And the payment information is also automatically updated on the Payments Report.

The Payment Report also shows something like “Account Level Reserve.” This is a portion of the funds Amazon holds in reserve.

Let’s learn more about it in the following section.

What Is An Amazon Account Level Reserve?

The Amazon Account Level Reserve serves as a financial buffer that Amazon sets aside from your balance. This reserve is specifically designed to address potential chargebacks, returns, refunds, or any other claims that may arise after customers have received your product.

Amazon also reserves and uses the fund to prevent scam activities.

In the past, when Amazon didn’t hold any money, scammers used to sell tons of inventory for cheap, with a long delivery time. And as soon as the money hits their account, they used to disappear before Amazon knew what was going on.

Amazon then had to refund the angry customers from their own pockets.

Here are some other reasons Amazon holds a reserve on your seller account:

- You have open A-to-Z guarantee claims

- You have a low-performing seller account

- You have chargebacks on your orders

- You have a payment information error in your bank account

- Local tax regulations in the geography you’re selling

Recommended Guide: Everything you need to know about Amazon’s Tax Exemption Program.

Now, let’s delve into the details of how Amazon determines the reserve amount and assigns different tiers to sellers based on various factors.

Recommended read: Amazon Power Seller Hacks to Maximize Profits.

Amazon’s Reserve Tiers

Amazon decides the reserve amount based on multiple factors, including account age, disputes, Order Defect Rate (ODR), account performance, etc.

Here are the eligibility criteria for each tier:

| Reserve Tier | Reserve Amount | Eligibility |

|---|---|---|

| Tier I | 100% of payments processed over the past week | - You are a new Amazon Seller. |

| Tier II | Higher of: 3% of daily processed payments averaged over the past 28 days The total value of unresolved transaction disputes | You have been an Amazon Seller for a year and have a minimum of 100 completed orders. - You have been a Seller for at least six months, have a minimum of 100 completed orders, and have maintained an ODR below 1%. |

| Tier II-Plus | The total value of unresolved transaction disputes | You are in Tier II. - You have maintained an ODR below 1% averaged over the past 60 days. |

Note: If your ODR reaches the 1% threshold, you will automatically revert to Tier II until you

How to Avoid An Account-Level Reserve

Even though avoiding account-level reserve is not always possible, you can still take some measures to avoid or reduce account-level reserve.

Here are some of them:

- Run an audit on your account and see if your seller performance always meets Amazon’s criteria

- Resolve customer disputes quickly and respond to customer’s feedback.

- Follow Amazon’s fulfillment guidelines thoroughly

- Create high-quality products and sell them to customers

- Offer a robust customer service experience

- Optimize the shipping process to prevent slow deliveries and shipping mistakes

- Maintain a sub 1% order defect rate.

By implementing these proactive strategies and maintaining a strong seller performance, you can significantly reduce the likelihood of having an account-level reserve imposed on your Amazon seller account.

How Can I Get Amazon Seller Payouts Faster?

Amazon has recently launched Express Payout to help sellers get their money faster.

With this solution, instead of waiting for 5 days for the money to hit your account, eligible sellers can receive deposits as fast as 24 hours.

Who can use Express Payout?

To take advantage of Express Payout, you must meet the following criteria:

- Sellers should have an account with an in-network U.S. bank: Express Payout is currently available only to sellers with a U.S. bank account that is part of Amazon’s network.

- Sellers should live in one of the 50 states: Sellers residing in U.S. territories are not eligible for Express Payout/

- Have transactions of $1 million or below Express Payout is designed for sellers with $1 million or fewer transactions at the time of the payment initiation.

If you meet all the requirements mentioned above, you can easily opt-in for the free Express Payout service. Simply visit the Deposit Methods page on Seller Central (login required) and enable the service.

Is There Any Fee For Express Payout?

For a limited time, Express Payout is available to sellers free of charge until September 2023.

This promotional period allows sellers to experience the benefits of faster payouts at no additional cost.

However, a flat fee of 50 cents per Express Payout will be applicable after the promotional period ends.

Which Payouts are Affected Once a Seller Signs Up?

Once you enroll in the Express Payout, all payouts can be processed through this service. This includes Amazon’s scheduled payouts, as well as manually-initiated payouts.

You also need to keep in mind that these solutions only work with certain bank accounts.

Opting out of Express Payout

If you initially choose Express Payout but later decide to opt out, the payment method will roll back to the default Standard Payout. This type of payout uses ACH payment networks and takes three to five days to complete.

Why Haven’t I Been Paid Yet?

Even if you play all your cards right, still some time you can see that your payment is on hold. However, there’s no need to panic.

Amazon may hold your payment for several common reasons, which include

- New Seller Account: New sellers have to wait for 30 days initially to get paid by Amazon. After that, the 14-day payment cycle will start.

- Missing or Incorrect Bank Account Information: The payment might not get cleared if you have incorrect bank details in the seller’s central account.

- Amazon-Prohibited Online Payment Systems: If you have set up an online payment system like PayPal as your payment account, it may lead to payment delays.

- Negative/Zero Account Balance: Amazon may hold your payment until the outstanding balance is settled if your seller account has a negative or zero balance. Review your account for any outstanding fees or reimbursements that need to be addressed.

If none of these applies to your account, but your payment is still on hold, you can reach out to Amazon to clear your balance.

How to Stay Ahead of the Amazon Seller Payment Schedule

As an Amazon seller, staying on top of your cash flow can make or break your business. With Amazon’s payment schedule causing delays sometimes, it’s essential to have proper strategies to ensure a steady flow of funds.

Let’s see some proven ways to strengthen your cash flow.

Stay Updated On Numbers

Only with a clear understanding of your business’s financial landscape can you make informed decisions about your business.

Leverage comprehensive analytics platforms like SellerApp to gain valuable insights into your sales behavior, track sales, and Inventory KPIs, and understand trends to forecast future performance accurately.

Build a Safety Net

Create a cash reserve or emergency fund to tackle unexpected expenses. Set up an automated monthly transfer of a percentage of your revenue into a separate account. While it’s important not to rely on these funds regularly, having a safety net will provide peace of mind and bridge the gap during periods of delayed Amazon payouts.

Adopt Multichannel Selling

Don’t limit yourself to Amazon alone. Explore other sales channels to expand your reach and diversify your income streams.

Research shows that businesses selling on multiple marketplaces generate 190% more revenue than those confined to a single platform.

Adding multiple channels in your sales funnel can diversify your income streams, increase sales, and get more payout dates so that you won’t be entirely dry at any point in time.

Recommended Guide: What is the difference between multichannel and omnichannel retailing?

Tap into Your Support Network

If you face a significant cash flow gap, consider reaching out to family or friends who may be willing to provide a loan. Ensure that you establish clear terms and create a formal agreement to maintain fairness and legality in the transaction.

Harness the Power of Business Credit Cards

Utilize a business credit card as an emergency resource. Choose a card wisely, focusing on factors like interest rates and benefits such as points or cash back. Look for cards offering 0% balance transfers, enabling you to manage payments more effectively if a lump sum payment is challenging.

Explore Traditional Bank Loans

Though securing a traditional bank loan can be challenging for e-commerce businesses, it’s worth exploring if your business meets the criteria. Look for reasonable interest rates and carefully consider the terms before deciding.

Final Thoughts

Don’t let the Amazon seller payment schedule hinder your growth. There are smart options to get the Amazon seller’s payout quickly.

More important is understanding numbers. Take your time and organize your sales and revenue data and create a solid saving strategy.

With a clear understanding of your finances and growth, you can explore new marketplaces and expand your business into new geographies to diversify your income stream.

Learn more about multichannel selling from this guide.

You can also partner with reliable PPC experts to understand the intricacies of Amazon selling and take your business to new heights.

At SellerApp, we have a proven track record of helping over 20,000 brands grow their revenue. We’ve also worked with renowned brands like Coca-Cola and Phillips to optimize their business growth, and we can do the same for you.

Our team of experts is equipped with the knowledge and expertise to optimize your Amazon PPC campaigns, increase your visibility, and drive targeted traffic to your listings.

Additional Read:

How to calculate the break-even RoAS for Amazon?

How do you transfer ownership of an Amazon seller account?

What are Amazon’s editorial recommendations?

Amazon buyer-seller messages that are allowed

How to Find Profitable Products with Amazon Best Seller Trends

Valder

November 12, 2023Informative blog

Clare Thomas

March 15, 2024Thank you.

Blake

November 27, 2023Always learning something with the help of SellerApp.

Clare Thomas

March 15, 2024Very happy to hear that.