What Should Every Seller Know About Profit and Loss Statements on Amazon

“Your business success depends on knowing your numbers.”

The main goal of an Amazon seller is to get more profits and increase the earning potential over time.

But that doesn’t happen all the time.

Joe started his Amazon business in 2021, and he quickly crossed $100,000 in sales with competitive pricing and aggressive advertising.

He thought he had hit the jackpot, only to realize his net profit at the end of the year was only $200.

Joe is not alone! Many sellers on Amazon go through the same struggle because they don’t track profits for their business.

The good thing is you can avoid that by tracking the profit & loss statement of your business and ensuring steady growth.

This isn’t difficult. This article explains everything you need to know about Profit and Loss (P&L) statements for Amazon sellers.

Quick Guide:

- What is a profit & loss report for Amazon’s business?

- P&L terminology explained

- How to create a P&L statement as an Amazon seller?

- How to analyze P&L statements for your business?

Why is a Profit & Loss Statement Important for Your Business?

A profit and loss statement (P&L) helps you understand your business’s revenue, costs, and expenses over time.

You can use this statement to understand the growth of your business and make more strategic decisions to maximize profits.

For example, if you see your Amazon advertising costs have increased significantly over the past few months, but the net profit has not improved, you can take some steps to increase the net profit, like

- Reducing the cost of goods,

- Increasing product price,

- Investing in building a brand to get more organic sales, etc.

- P&L statement also helps you make better business decisions.

Let’s say you’ve set a goal to increase sales by 30% YoY. During the P&L analysis, you see the sales are lower than expected, but your profits are better than the previous year. You can then invest more money in advertising to increase your sales numbers.

On the other hand, if your sales are higher than anticipated, you can focus more time on optimizing advertising and marketing efforts to maximize your profits or invest in a new product line to grow your business further.

P&L Terminology Explained

P&L statements are filled with tons of financial indicators. And it’s important to understand these indicators to make sense of the report.

Terminologies you should know:

Sales Revenue

It’s the total amount of money earned from selling products before any deductions, like the cost of goods sold or expenses related to the sale of the products.

Sales revenue often helps you determine business valuation and set revenue targets for long-term growth.

Formula:

Sales Revenue: Number of units sold x Average selling price per unit.

For example, if you sell 100 units of a product for $10 per unit, the sales revenue would be 100 x $10 = $1,000.

Net Sales Revenue:

Net sales revenue is the total amount you earn from selling products after deducting the discounts, customer reimbursements, accounting costs, and other costs.

It helps you understand the profitability of the products.

Net sales revenue = Sales revenue - Sales Returns - Discount - Other Deductions.

For example, let’s say you sell 2000 units of a product at $20 each, give a $1,000 discount, and get 20 items in return from the customers. Then the net sales revenue will be:

Net Sales Revenue = (2000 x $20) – $1000 – (20 x $20) = $38,600

Cost of Goods Sold

The cost of Goods Sold, or COGS is the total cost of producing a product. This includes the cost of materials, labor, inbound and outbound shipping costs, and other expenses directly related to the production of the product.

If you don’t manufacture the product, the COGS will be the cost of purchasing the product from suppliers.

COGS is a variable cost and often fluctuates depending on various factors, such as the price of raw materials, labor cost, inventory cost, and many other factors.

Overhead Cost

These are the fixed cost for your business not directly related to the production or sales of the product but are necessary for the business operations, such as

- Advertising costs,

- Marketing costs,

- Employee salary,

- Amazon fees,

- Warehouse costs, etc.

Gross Profit

Gross profit is net sales after deducting the COGS.

In layman’s terms, if you sell a product for $100 and the COGS is $50, the gross profit would be $100 – $50 = $50.

But this is not the true profit..!

Gross profit does not consider other expenses, such as overhead costs or taxes. So, your net profit comes into the picture.

Amazon Net Profit/ Net Income

Net profit is the actual profit left in your bank account after deducting the COGS, taxes, debts, and overhead expenses.

Net Profit = Gross Profit - COGS - Taxes - Overhead expenses

For example, if you sell a product for $100 with a COGS of $50 and overhead costs of $20, the net profit would be $100 – $50 – $20 = $30.

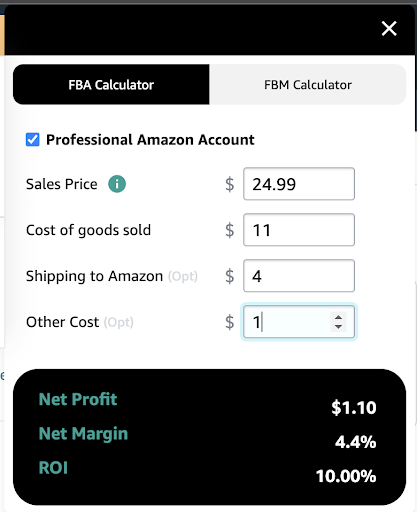

Now, there’s an easy way to estimate the net profit of a product on Amazon with SellerApp’s FBA calculator.

- Install the SellerApp Chrome Extension.

- Go to a product listing similar to yours on Amazon.

- Click on SellerApp chrome extension >> Profit calculator

- Add COGS and shipping costs to the calculator to get the estimated net profit.

How to Create a P&L Statement as an Amazon Seller

We know you dread creating the P&L statement for your business.

We do too!

But don’t skip it if you’re serious about growing your income.

Follow the simple steps to create a simple P&L statement for your business.

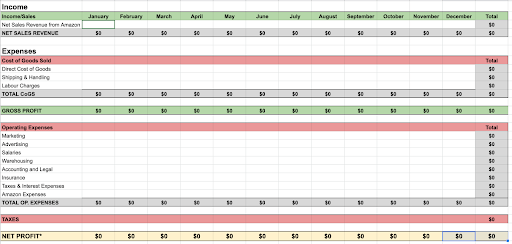

Create a Simple Income & Expense Tracking Sheet

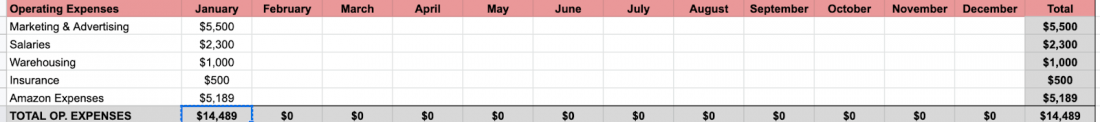

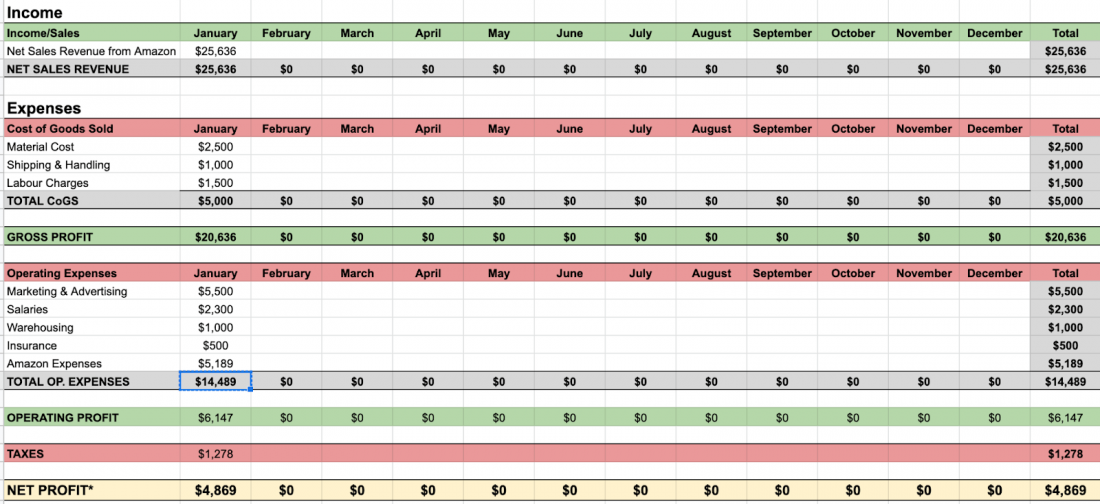

P&L statement begins with creating a simple income & expenses tracking spreadsheet like the following:

Here, add all the expenses and income month on month to calculate the net profit.

Get the Net Sales Revenue from Amazon

Next, calculate the net sales revenue of your business.

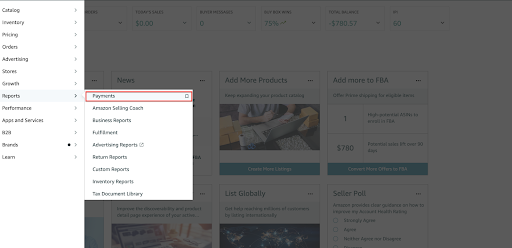

Thankfully, Amazon has made it easier to get net sales revenue numbers from the Seller Central account.

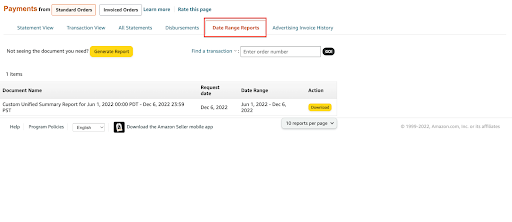

- Log in to your Seller Central account and go to Reports > Payments.

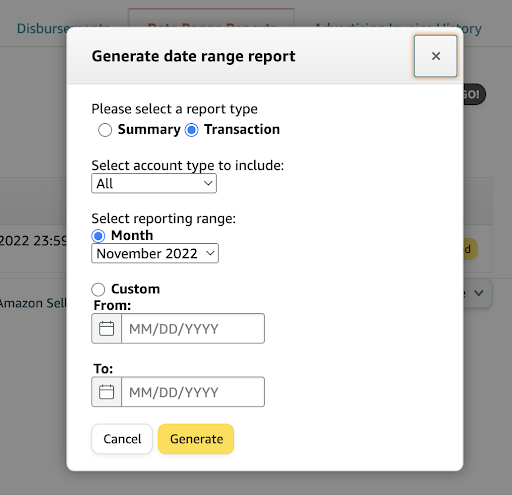

- Go to the Date range report and click on Generate report.

- Select Summary. If you want to create a monthly statement, choose that timeframe, and click Generate.

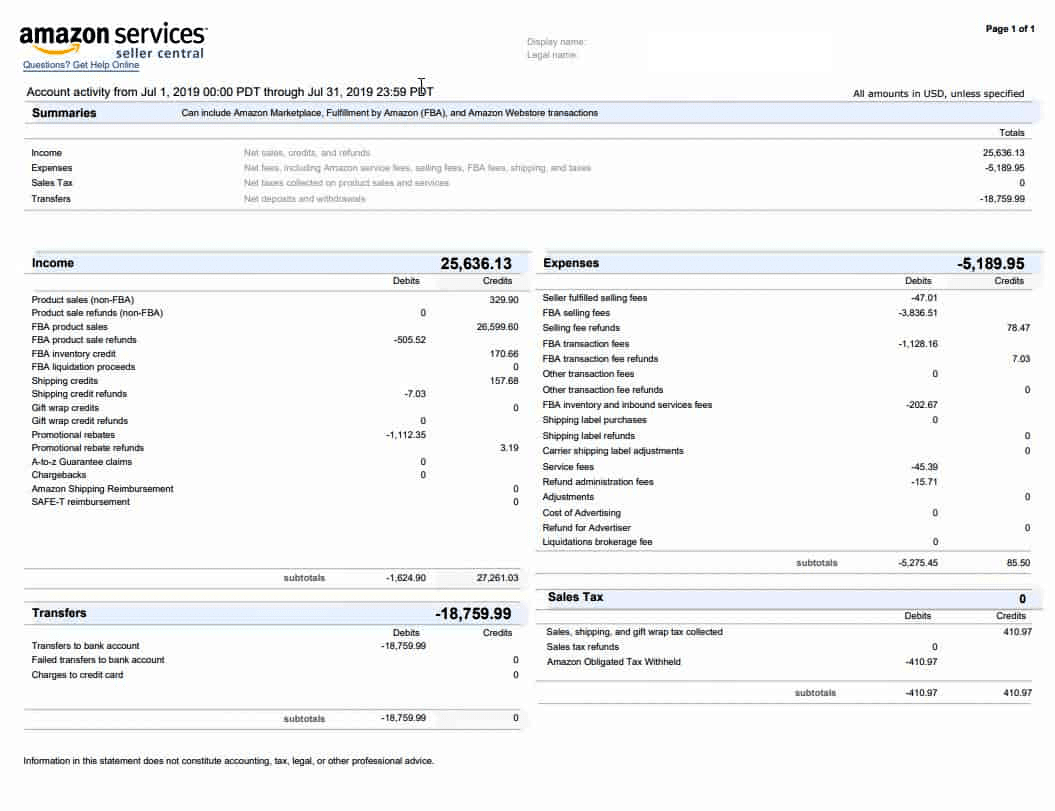

- It shows the total Amazon expenses and net sales revenue for your business for a specific period. Add these data to your Income & Expense tracker sheet.

In this example, you can see the net sales revenue for January is $25,636.13, and the total Amazon fee is $5189.95.

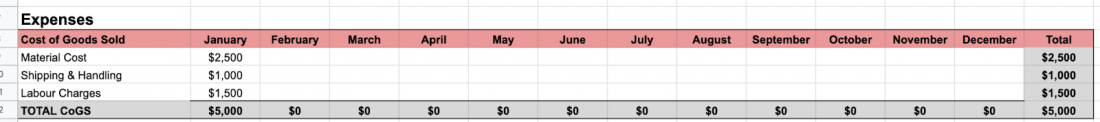

Figure Out the Cost of Goods Sold

The COGS helps you understand how much money you’re investing in the product directly.

Let’s say you’re selling a wallet, then you must include the cost of purchases as COGS for the product for the specific month.

If you’re manufacturing the wallets, you need to include the material cost, labor cost, shipping cost, and other manufacturing-related costs in your COGS for the month.

For example, the material cost for manufacturing wallets in January is $2,500, shipping & handling charges are $1,000, and labor costs are $1,500. Then the COGS will be ($2,500 + $1,000 + $1,500) = $5,000 for the month.

Calculate the Gross Profit

Next, subtract the COGS from net sales revenue to get the gross profit/loss for your business.

Gross Profit = Net Sales Revenue - Cost of Goods Sold

In the above example, the net sales revenue is $25,636.13, and the COGS is $5,000. So, the gross profit will be: $25,636.13 – $5,000 = $20,636

Calculate Overhead Costs

Accurately tracking overhead costs is essential to calculate profits in the eCommerce business.

We recommend keeping records of everything to ensure you don’t pull your hair while calculating the overhead costs at the end of the month.

Let’s say, in January, the operating expenses of running your business were:

- Marketing and advertising costs = $5,500

- Salaries = $2,300

- Warehouse costs = $1,000

- Insurance = $500

- Amazon expenses (from Amazon date range report) = $5,189

The total overhead cost for January is: ($5,500 + $2,300 + $1,000 + $500 + $5,189) = $14,489

Find Out Your Operating Profit

Subtracting the overhead costs from the gross profit will give you the operating profit.

If your gross profit in January is $20,636, and the overhead cost is $14,489, then the operating profit is ($20,636 – $14,489) = $6,147

Operating Profit = Gross Profit – Overhead Costs

If you’ve other income streams, like interests, or dividends on your investments, add that to the operating profit to get the earnings before interest, taxes, depreciation, and amortization or EBITDA.

If selling on Amazon is your only source of income, then the operating profit equals your EBITDA.

Calculate Your Net Income

Now that you have the EBITDA, calculate your tax based on your business type and subtract that from the EBITDA to get the net or true income.

Let’s say in January, your EBITDA is $6,147, and the total tax is $1,278; then, your net profit will be $6,147 – $1,278 = $4,869.

Here’s what the P&L data looks like in the spreadsheet:

Note: You don’t have to give money from your profit as sales tax. Amazon takes care of collecting and filing the sales tax for almost all the states in the USA for a small fee of 2.9% per transaction.

Learn more about Amazon sales tax from here.

How to Analyze P&L Statements to Grow Your Business

Understanding data can be intimidating. But if you can learn where to look, you’ll quickly become a pro in no time.

We’ve gathered some easy ways to help you analyze the P&L statement:

- Review your sales revenue month-on-month to see if it’s growing. If you notice a good spike in sales revenue in some months, what is the reason?

Is it because of seasonal demand? Or did you increase the advertising budget for that month?

Try to identify the reasons and replicate that in the future to increase sales.

- Next, review the COGS. It’s the cost directly related to your product. It will naturally increase as the sales grow. But you can still figure out some ways to reduce the COGS.

For example,

- Get more discounts from suppliers by ordering in bulk or paying in advance.

- Find cheaper suppliers with the same quality.

- Ask for a line of credit, and pay in installments to maintain a steady cash flow of your business.

- Lastly, calculate the profit margin, and see how your profit margin is faring compared to your competitors. If it’s lower, try optimizing the costs to increase your profit margin.

Examining these insights will give you a good idea about the financial health of your business and help you make strategic decisions.

Recommended Guide: How Does Amazon Seller Payment Schedule Work?

Final Thoughts

Looking at the P&L statement of your business is essential to drive growth for your business.

From sales revenue to COGS, evaluating every metric helps you find opportunities to invest in marketing, advertising, and other departments to ensure your business is constantly growing.

If you have multiple products, we recommend the SellerApp sales analytics to study how your products perform at the ASIN level, make changes to COGS or overhead costs and increase net profits.

Found this helpful? Comment below and tell us what other topics you want to learn more about.

Recommended read:

Benefits of having effective inbound and outbound logistics

Noah

December 14, 2022I found nice information here. TQ

Oliver

December 14, 2022Your blog provided us with valuable information to work on. You have done a marvelous job!

George

December 14, 2022Thank you for all this great informative stuff and blog posts!