What Is An Amazon FBA Aggregator?

Aggregators are a pivotal part of an Amazon seller’s journey. Every year thousands of new eCommerce sellers venture into Amazon and aggregators play a major role in taking the businesses of sellers from one level to the next.

Once a brand is established and unsure of what to do next or wants to exit, that’s where aggregators step in. Understanding aggregators, what they’re looking for and what you can expect from them is a vast subject.

In this article, we’re going to cover everything you need to know about Amazon aggregators and how to choose the right one.

Quick Guide

- What is an Amazon Aggregator?

- Top Amazon Aggregators

- What are Amazon Aggregators looking for?

- Amazon aggregator business model

- How to know if you should sell your business to an aggregator?

- How to determine which aggregator should buy your business?

- What challenges do aggregators face?

- How do aggregators handle the long-term growth of your business post-acquisition?

- Advantages of selling to aggregators

- Final thoughts

What is an Amazon Aggregator?

Amazon aggregators, also known as acquirers or consolidators, work to acquire and scale the business of a brand.

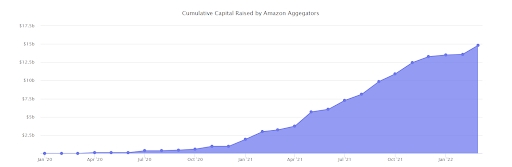

These aggregators come into the market with large funds to take over businesses and scale them in order to generate revenue for the company and its investors and stakeholders.

They’re well versed with what kind of companies they need to acquire and what they need to do to help the company expand.

Top Amazon Aggregators

There are over 90 active Amazon aggregators today and the following are some of the biggest players in the game:

Thrasio

Thrasio Holdings is one of the biggest Amazon aggregator companies in the world, established in 2018.

They’ve made a name for themselves in the market and have inspired something known as a Thrasio-style startup which basically refers to startups that carry out acquiring digital-first brands in order to scale the brand’s products.

The company is valued at $1B. If you are a brand that generates $1M in revenue annually, then you fall under the category of companies that fit Thrasio’s criteria for acquiring.

Thrasio evaluates a business potential by analyzing it according to a 500+ checkpoint process. This includes the brand’s supply chain, marketing, etc, after which they formulate a business plan accordingly to improve the nitty-gritty aspects of the brand’s products.

Learn more about the Amazon supply chain here.

They pride themselves on being a Top 5 Amazon seller and elevate their brands to earn Best Seller Badges and Amazon’s Choice Rankings on an international scale as well.

Additional read: All You Need to Know About Different Types of Amazon Seller Badges.

Perch

Perch is another massive Amazon FBA aggregator and is a direct competitor to Thrasio. They have a portfolio of over 80 brands and are only interested in acquiring brands with annual revenue of $1M.

They’re a well-respected and trusted aggregator and the criteria to be acquired by them include having a large loyal customer base, positive product reviews, and a portfolio of high-quality products belonging to various categories.

When Perch first acquires a brand, their initial focus is on “in-place optimization,”. This refers to the company using its resources to better the products in such a way that they generate higher sales on Amazon. How? With advanced ad optimization, improving merchandising, and ensuring that the inventory doesn’t run out of stock at crucial times.

Their next step is focusing on globalization prior to launching their products on other eCommerce platforms.

Unybrands

If you are a brand that generates a minimum of $1M in annual revenue, Unybrands is another option. They are interested in acquiring only specific categories of products and they include sports and fitness, lifestyle and arts and supplements, personal care, pet care, household products, juvenile & baby, garden & outdoor, and supplements.

They are a company that uses their proprietary technology to scale brands and grow them to new profitable heights on as well as off Amazon and especially on an international scale. They are also known to offer flexible opportunities for business owners to exit along with cash-upfront deals and also allow the business owners to stay on as advisories.

Post-acquisition, Unybrands takes over everything from handling logistics & supply chains to enhancing performance marketing and expanding the business to new domestic and global markets. Launching new product lines, and on new platforms–including DTC platforms for enhanced customer experiences is part of their acquisition strategy.

Benitago

Benitago was established in 2016 by Benedict Dohmen and Santiago Nestares who made their own beginnings as Amazon sellers. They are known to purchase brands that sell unique products and are not explored by the majority of aggregators.

If you wish to be purchased by Benitago, your annual revenue needs to be $3M which needs to be translated from $1M in your SDE/EBITDA earnings.

They have scaled over 350 products ranging across more than 15 categories, from beauty, maternity, and nutrition to orthopedic, pet supplies, and electronic brands.

They are famed for their Aggregator Offer Match Guarantee which entails them price matching an offer from any other aggregator while also throwing in an added bonus of $250,000.

Their acquisition process entails 3 important steps. First, they evaluate your business over a course of 1 week to ascertain its worth after which they send you an LOI they deem fit for your company according to their criteria.

Next, over the course of the next 7 to 14 days, they dig deep into your company data to figure out what your strengths and weaknesses are and in what way they can build on your strengths.

The last step which takes about 1-2 weeks involves drafting the contracts and depositing your funds to finalize the acquisition. Their brands have recorded a 30% YoY growth rate post-acquisition.

Merama

Merama’s operations are concentrated around Latin American brands. Their portfolio has over 20 brands from Chile, Peru, Colombia, and other Latin American countries as well as the US.

Their strategy varies a little from other aggregators in that they acquire a stake in your company when they invest and do not acquire 100% of it. Sellers can opt to cash out for the shares they sell.

Their “Future exit” concept is directed at scaling a business to over $1B with exit options after 3 to 5 years.

Their products belong to a variety of categories, unlike some other aggregators who are focused on very few specific categories. They focus on international expansion, platform expansion and growing D2C channels, marketing, and BI investment.

They also give weightage to the development of new products and complementary products and categories, cost optimization, and execute automation of processes along with standardizing suppliers.

Additional Read: Turbocharge Your Business with Amazon FBA Automation.

SellerX

SellerX is a Berlin-based company that has made its way to the spot in a fairly short period of time. If you have seller accounts of marketplaces in the UK, USA, and Germany, in addition to the other qualifications, then the company will definitely be interested in acquiring you.

They are interested in acquiring brands whose products have star ratings of at least 4.3 and need to be products that are not seasonal and can generate year-long demand with over 30% YoY growth.

This aggregator too looks to acquire companies with annual revenue of $1M and have raised over $700 million in the capital. Their portfolio consists of over 40 brands selling more than 25,000 products in total.

What do Amazon Aggregators look for while acquiring companies?

When aggregators are looking to acquire a brand, there’s a certain criterion that the brand has to meet. Any and every brand will not make a good fit.

It has to be a brand that actually has the potential to grow so that the aggregator can use its resources to build the business and turn great profits.

Here are some of the things in aggregators’ checklists before narrowing down on a brand:

- Aggregators are always on the lookout for brands registered with the Amazon Brand Registry or private label ones or brands manufacturing and selling their own products.

- If a seller uses Amazon FBA, it’s a huge plus point as FBA makes it easier to qualify for Prime. Also, it comprehensively solves all the fulfillment-related issues and aggregators don’t have to worry about the logistics of storing, packaging and shipping.

- The fewer SKUs, the better. This helps the aggregators to focus on the few brands at hand as it facilitates the generation of higher revenues.

- If your products belong to a niche market sector then aggregators will definitely be interested in your brand as many of them go after very specific product niches.

- The profitability of the brand has to be consistent and start at a value of $200k at least with net margins anywhere between 10-15%. It’s not just about the performance of the company at that given time but more about how the business has been performing over time and whether the profits are moving up. The aggregators need to be able to see long-term profitability.

- Amazon aggregators are interested in the number of sales that you do solely through Amazon. A lot of eCommerce sellers do business online on multiple platforms other than Amazon like eBay, Walmart, Craigslist, etc, and the sales generated by the sellers on those platforms may be high. But Amazon aggregators are specifically interested in businesses that get Amazon sales ranging anywhere from 30% or going all the way up to 80%.

Amazon Aggregator business model

An Amazon FBA aggregator’s business model consists of acquiring small Amazon businesses that are already well established and scaling them in order to expand and generate higher profits.

There are different types of business models aggregators are looking for – Private Label, Proprietary, and Wholesale. As mentioned earlier, aggregators give more weightage to private label enterprises as they’re a more consolidated choice.

Proprietary products or those that belong to a niche market are also a popular choice if they’re the kind of business that generates good profits.

Knowing the value of your business before selling to an aggregator

Before selling your Amazon business, it’s very important to know your SDE (Seller’s Discretionary Earnings). SDE is what a company earns, the cash flow it has generated over a period of one year.

The formula for calculating SDE is:

SDE = Net Profit + Add backs

While SDE calculates the company’s earnings, it excludes earnings before depreciation, amortization, income taxes, etc. It is vital to take into consideration because it provides acquirers with a clear idea of the amount that they are liable to receive after purchasing the company.

SDE does not denote only profit and it is the clearest depiction of a company’s earnings as compared to measuring just the revenue.

Recommended to read: Amazon Profit Margin: All that Finally Matters.

Should you sell your business to an aggregator?

Starting off a business is always very exciting and your motivation and interest levels are at an all-time high in the initial stages. However, as time passes and your business grows, it becomes more and more difficult to run it.

You have to have all the resources in place, funds to expand and hire more personnel to handle the growing size of your operations, and more. While many sellers take it forward, a lot of other sellers are satisfied when their company reaches a certain level and are then only looking to successfully exit from their business. If you strongly feel like you’ve reached that saturation point then you should sell your business.

A lot of sellers start off a business with the sole intention of building it up to a point where they can sell it for a huge profit. They invest in selling on Amazon and advertising those products in order to bring in high revenue so that if they choose to sell, they know they’re in for a big payout which they can then use to fund some other business ventures.

If you’re a seller who is motivated by trying your hand at inspiring new business ideas, then you will probably want to invest your time and money into developing your Amazon business as your end game is to find an aggregator who will pay you what your company’s worth.

Recommended read: How Does Amazon Inspire Work?

Sometimes, sellers personally feel like they’ve done as much as they can with their business but also feel like it has the potential to scale up in someone else’s hands. This is when you should consider selling to an aggregator because they have the personnel, experience, and skills and will do all the due diligence to acquire your business and expand it to greater heights.

Individual sellers sometimes find it difficult to expand their business on their own. This is owing to the complexity of all the paperwork and documentation involved therefore aggregators are a strong choice as they know how to systematically deal with everything.

Recommended read: What is the registration process for Walmart Plus.

How much do Amazon Aggregators pay?

Every aggregator varies in how much they’re willing to pay to acquire a brand. They look at various factors like the size of the company, potential the company has for long-term sustainability, channel, and size of inventory amongst other things.

Their final offer is an agglomeration of several important factors which is subjective to every individual company. There isn’t a standard sum that aggregators pay that is universal to all companies.

Where do Amazon Aggregators get their funding from?

Amazon FBA aggregators receive their funding from institutional investors. The leading Amazon aggregators have not fully divulged their funding sources however the committed capital is known to consist of equity as well as debt.

How to determine which aggregator should buy your business?

For a seller, his Amazon business is something that he would have poured his heart and soul into. From running the business to sustaining profits and ensuring everything goes smoothly, sellers devote all their time and energy to their Amazon businesses.

So it’s only natural that when the time comes to sell, sellers want to go with an aggregator who values and rewards the fruits of their labor and understands the business.

It’s not enough if the aggregator offers you a good price, it also matters how they plan to take your business forward in what way they’re going to scale.

There are some important questions that you need to ask your aggregators and you need to evaluate them along the lines of the points mentioned below:

- Firstly, you need to evaluate the level of expertise, knowledge, and experience that the potential aggregator has in running businesses like yours. Being an experienced aggregator, in general, is good but you need to be sure that they understand your products and niche well.

- Meet with as many buyers as possible. Each one could have a different perspective on what they can do to make your business better. Make sure you get a clear picture of who will be operating your brand, assess if the potential brand managers have what it takes to build your brand. Ask them how they would deal with any issues that come up. Your brand is valuable to you and sellers most definitely have an emotional attachment to their brands, so you have to make sure the aggregator satisfactorily answers all your questions.

- The due diligence process is very important and often complicated so you need to ensure that the aggregator has the capability to carry it all out seamlessly. They also have to have the right amount of funds in place because, at the end of the day, your brand needs to get its money’s worth when it is acquired by a new buyer.

- There are different types of buyers for your FBA business and you must choose one according to what their best suited for. If you’re a seller whose products belong to a niche market or are looking for an aggregator who can offer you more pliable deals, then an individual buyer could be most suitable to acquire your business. However, you may have to overlook the experience aspect of it as individual sellers may not be as well-versed with acquiring and scaling as are other aggregators.

- If you are focused on experiential aggregators, then an institutional buyer like Thrasio, Benitago, etc, are good choices. Opting for these kinds of buyers comes with a seal of guarantee that everything will run smoothly and over a quicker timeline as they are bound by their reputation in the market. They also have better funding available so you can rest assured that you will receive the payout you’re valued at with no complications.

Additional Read: How to Answer Customer Questions on Amazon.

What kind of challenges do aggregators face?

However experienced an aggregator may be, there’s bound to be some bottlenecks and other challenges they face along the way. Let’s discuss some of the most common challenges that Amazon FBA aggregators face:

- FBA aggregators often look to expand internationally after acquiring a business. Some of the most common problems that arise are with international taxes, and additional logistics charges for shipping, storage, etc. Different countries have varying tax regulations and policies for that particular marketplace. Not adhering to the results in penalties being imposed and suspension of accounts.

- When aggregators acquire a business, they’re sometimes faced with unprecedented complications. Big aggregators in the industry buy several small businesses every month. This means they have to deal with migrating and integrating all the operations of each of those companies into their enterprise and this could be quite a convoluted process. Even inventory predictions are often miscalculated and being understocked or overstocked can result in the business’s profits and sales taking a huge hit.

- Aggregators are also faced with a lack of proper insight into sales data. Without proper sales data, it is difficult to take the necessary steps to scale revenue. Many a time, a particular brand may seem successful from a top-level which leads them to be bought by an aggregator. However, only with proper market research and competitor analysis can aggregators be able to ascertain the demand level and profitability of a product for the long -term. So it is important to ensure that this important step of conducting thorough research and analysis is not skipped out.

- FBA aggregators also need to ensure that their strategies are in place for every time of the year and the demands keep changing at different peak seasons of the year. It’s important to set your holiday sales prices well in advance so that there is no delay at crucial, busy times and it reduces the chances of losing out on high volume sales.

How do aggregators handle brands post-acquisition?

Amazon Aggregators have a team of experts who specialize in running the business of a brand by deploying the best strategies using advanced technology and tools of their own. Every brand is different and they formulate a plan of action that best suits that particular brand.

Selling on Amazon is an all-encompassing process so aggregators ensure the listings are optimized and conduct keyword research to find and use high-converting ones that will enhance the brand’s Amazon SEO.

Even the brand’s product images are optimized for maximum conversions along with revamping the look of the product and its labeling and packaging.

An important part of selling on Amazon is PPC. So aggregators also launch PPC campaigns and optimize them according to the allocated budget and use advanced tools to control their ad spend while also ensuring a good ROI.

Wherever adjustment of pricing is needed, that is carried out too, and then they look to expand their sales by launching on other platforms and eventually on a global scale if there is strong potential.

Aggregators tend to go the extra mile to understand your brand while purchasing it and they know that nobody knows the brand and its product as well as its first owner. Therefore, it is not uncommon for aggregators to ask the initial owners to be a part of the company in order to serve as advisors and guide them when they hit bottlenecks.

Overall, aggregators look to scale a brand at a much faster rate than they did earlier and have the technology, tools, and manpower to do the same.

Advantages of selling to aggregators

There are a plethora of advantages when it comes to selling your business to Amazon aggregators. Let’s take a look at some of them:

- Aggregators pave the way for SMBs to scale to an extent that would not normally be possible for them due to a lack of funding, resources, and other crucial factors.

- They have enough funding and have no need for external financing while buying a brand so the process is faster and smoother.

- Aggregators are known to have teams of professional Amazon maestros who work to scale a brand along with technology and data that are proven to increase sales and revenue for SMBs.

- The top aggregators only pick the best companies with superb potential to transform them into international businesses. So if you manage to sell to a well-reputed aggregator then you can rest assured your company will be making big moves in international marketplaces thanks to the aggregators’ prowess in Amazon selling and advertising.

- Aggregators work on every aspect of your Amazon business – SEO, listing optimization, keyword research, product research, PPC, etc, to holistically scale your business.

Final Thoughts

Deciding if and when you should sell your business, which aggregator can best scale your brand, and who can pay you the best price is a process that calls for in-depth research and dedication. While selling your brand to an Amazon aggregator, you need to go through every aspect of the aggregator thoroughly and only then make a decision.

This article has covered everything you need to know about Amazon aggregators and the acquisition process as well as the post-acquisition functions of some of the biggest names in the market. You are now better equipped to confidently go about selling your business and make a decision that best suits your brand.

Additional Read:

What is the Amazon DTC master plan?

Master Inbound and Outbound Logistics to Gain a Competitive Edge

A Look at the Challenges DTC Brands is Confronting Today.

Penelope Anne

July 14, 2024Very helpful read, Appreciated.

Clare Thomas

July 31, 2024Thanks!

Thomas Wesley

July 15, 2024Very helpful article for amazon sellers, Appreciated.

Clare Thomas

July 31, 2024Thanks for your valuable feedback.

Stella Grace

July 15, 2024The information provided is Very enlightening. I liked it.

Clare Thomas

July 31, 2024I’m happy you enjoyed the blog! Thanks for reading.

Henry Thomas

July 17, 2024Really good points, one of the best guide for amazon sellers.

Clare Thomas

July 31, 2024Thanks for the feedback! Glad you found it useful.

Michael David

July 18, 2024This blog is fantastic and its a Must read content.

Clare Thomas

July 31, 2024Thank you for your support.